[ad_1]

During the Nice Recession, public discourse in regards to the economic system underwent one thing of a Nice Unhappiness.

For a lot of the rustic’s historical past, maximum American citizens assumed that the long run would carry them or their descendants larger affluence. In spite of periodic financial crises, the whole tale gave the look to be one among growth for each and every stratum of the inhabitants. The ones expectancies had been in large part borne out: The usual of dwelling loved by means of working-class American citizens for a lot of the mid-Twentieth century, for instance, used to be a long way awesome to that loved by means of prosperous American citizens a era or two previous.

However after the 2008 monetary disaster, the ones assumptions had been upended by means of a duration of intense financial struggling coupled with a newfound pastime amongst economists within the matter of inequality. Predictions of financial decline took over the dialog. The united states, a rustic lengthy recognized for its inveterate optimism, got here to dread the long run—during which it now gave the impression that most of the people would have much less and not more.

3 arguments equipped the highbrow basis for the Nice Unhappiness. The primary, influentially complex by means of the MIT economist David Autor, used to be that the wages of maximum American citizens had been stagnating for the primary time in dwelling reminiscence. Even if the source of revenue of reasonable American citizens had more or less doubled as soon as each and every era for many of the earlier century, salary enlargement for a lot of the inhabitants started to flatline within the Eighties. Through 2010, it seemed as regardless that poorer American citizens confronted a long term during which they might now not be expecting any actual development of their way of life.

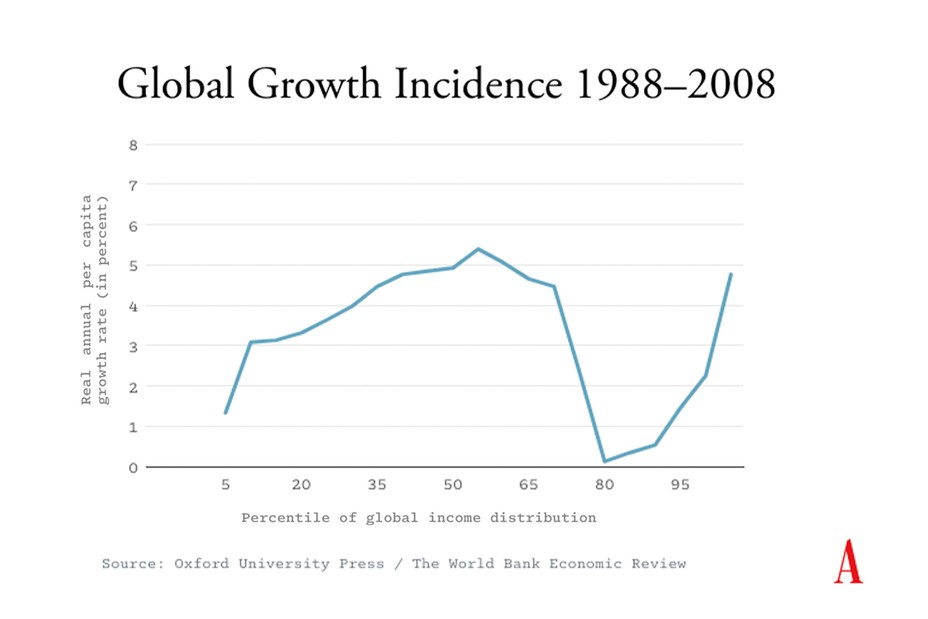

The second one argument needed to do with globalization’s have an effect on at the international distribution of source of revenue. In a graph that got here to be referred to as the “elephant curve,” the Serbian American economist Branko Milanović argued that the sector’s poorest folks had been experiencing handiest minor source of revenue enlargement; that the center percentiles had been reaping rewards mightily from globalization; that the ones within the upper-middle phase—which incorporated many business staff and folks within the carrier business in wealthy international locations, together with The united states—had observed their earning stagnate; and that the very richest had been making out like bandits. Globalization, it gave the impression, used to be a combined blessing, and a distinctly regarding one for the ground part of salary earners in industrialized economies corresponding to the USA.

The general, and maximum sweeping, argument used to be in regards to the nature and reasons of inequality. Whilst a lot of the inhabitants used to be simply retaining its personal in prosperity, the wealth and source of revenue of the richest American citizens had been emerging abruptly. In his 2013 marvel highest supplier, Capital within the Twenty-First Century, the French economist Thomas Piketty proposed that this pattern used to be prone to proceed. Arguing that the returns on capital had lengthy outstripped the ones of work, Piketty perceived to counsel that just a calamitous tournament corresponding to a significant warfare—or a thorough political transformation, which didn’t seem to be at the horizon—may just lend a hand tame the rage towards ever-greater inequality.

The Nice Unhappiness continues to form the best way many American citizens take into consideration the present and long term state of the economic system. However because the pandemic and the upward thrust of inflation have altered the sector economic system, the highbrow foundation for the thesis has begun to wobble. The explanations for financial pessimism have began to seem much less convincing than they as soon as had been. Is it time to revise the core tenets of the Nice Unhappiness?

One of the most distinguished hard work economists within the U.S., Autor has during the last decade equipped a lot of the proof in regards to the stagnation of American staff’ earning, particularly for the ones with no faculty level.

The U.S. economic system, Autor wrote in a extremely influential paper in 2010, is bifurcating. Whilst call for for high-skilled staff rose, call for for “middle-wage, middle-skill white-collar and blue-collar jobs” used to be contracting. The united states’s economic system, which had as soon as equipped various middle-class jobs, used to be splitting right into a extremely prosperous skilled stratum and a big the rest that used to be changing into extra immiserated. The full consequence, consistent with Autor, used to be “falling actual profits for noncollege staff” and “a pointy upward push within the inequality of wages.”

Autor’s previous paintings at the falling wages of a significant phase of the American body of workers makes it all of the extra notable that he now sounds way more constructive. As a result of firms had been desperately in search of staff on the tail-end of the pandemic, Autor argues in a operating paper revealed previous this yr, low-wage staff discovered themselves in a a lot better bargaining place. There was a outstanding reversal in financial fortunes.

“Disproportionate salary enlargement on the backside of the distribution lowered the varsity salary top rate and reversed the upward thrust in mixture salary inequality since 1980 by means of roughly one quarter,” Autor writes. The large winners of latest financial tendencies are exactly the ones teams that have been ignored in previous many years: “The upward thrust in wages used to be specifically sturdy amongst staff below 40 years of age and with no faculty level.”

Even after accounting for inflation, Autor presentations, the ground quarter of American staff has observed an important spice up in source of revenue for the primary time in years. The student who in the past wrote in regards to the “polarization” within the U.S. body of workers now concludes that the American economic system is experiencing an “sudden compression.” In different phrases, the wealth hole is narrowing with sudden velocity.

Autor isn’t the one main economist who is looking into doubt the underpinnings of the Nice Unhappiness. In keeping with Milanović, his “elephant curve” proved so influential partially as it showed fears many of us had in regards to the results of globalization. His well-known graph used to be, he now admits, an “empirical affirmation of what many concept.” He’s now not so certain about that piece of typical knowledge.

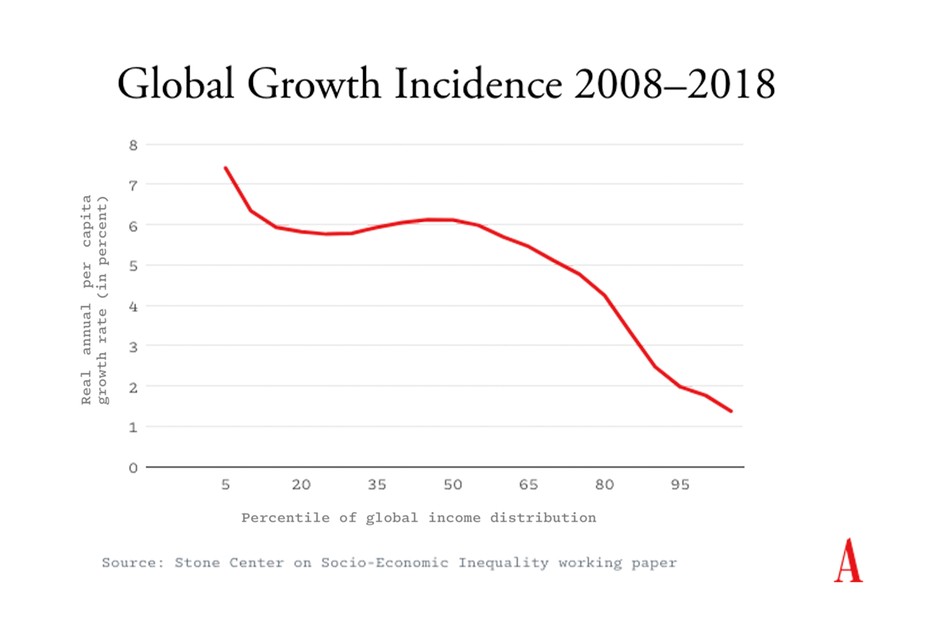

A couple of years in the past, Milanović got down to replace the unique elephant curve, which used to be according to information from 1988 to 2008. The outcome got here as a surprise—a favorable one. As soon as Milanović incorporated information for some other decade, to 2018, the curve modified form. As an alternative of the feature “upward push, fall, upward push once more” that had given the curve its viral title, its frequently falling gradient now perceived to paint a simple and a lot more constructive image. Over the 4 many years he now surveyed, the earning of the poorest folks on this planet rose very rapid, the ones of folks towards the center of the distribution rather rapid, and the ones of the richest quite sluggishly. International financial prerequisites had been bettering for almost everybody, and, opposite to standard knowledge, it used to be essentially the most needy, now not essentially the most prosperous, who had been reaping the best rewards.

In a contemporary article for Overseas Affairs, Milanović is going even additional. “We’re ceaselessly informed,” he writes, that “we are living in an age of inequality.” However while you have a look at the newest world information, that seems to be false: In reality, “the sector is rising extra equivalent than it’s been for over 100 years.”

To this present day, Piketty stays the consumer saint of the Nice Unhappiness. No philosopher is invoked extra steadily to justify the idea. However even Piketty’s pessimistic prognosis, made a decade in the past, has come to seem a lot much less dire.

Partially, it is because Piketty’s paintings has are available in for grievance from different economists. In keeping with one influential line of argument, Piketty mistook why returns on capital had been upper than returns to hard work in lots of industrialized international locations within the many years after International Conflict II. Absent concerted force to forestall this, Piketty had argued, the character of capitalism would all the time want billionaires and large companies over abnormal staff. However consistent with Matthew Rognlie, an economist at Northwestern College, Piketty’s reason for why inequality higher right through that duration used to be according to a misinterpretation of the knowledge.

The outsize returns on capital right through the latter part of the twentieth century, Rognlie argues, had been principally because of the large enlargement in area costs in metropolitan facilities corresponding to Paris and New York. If returns on capital had been better than returns to hard work over this era, the rationale used to be now not a common financial pattern however explicit political elements, corresponding to restrictive construction codes. As well as, the principle beneficiaries weren’t the billionaires and massive companies on which Piketty centered; quite, they had been the types of upper-middle-class pros who personal the majority of housing inventory in primary towns.

Economists proceed to discuss whether or not such criticisms hit the mark. However at the same time as Piketty defended his paintings, he himself began to strike a extra constructive word in regards to the long-term construction of the economic system. In his 2022 guide, A Transient Historical past of Equality, he talks about the upward thrust of inequality as an anomaly. “A minimum of because the finish of the eighteenth century there was a historic motion in opposition to equality,” he writes. “The arena of the 2020s, regardless of how unjust it’s going to appear, is extra egalitarian than that of 1950 or that of 1900, which have been themselves in lots of respects extra egalitarian than the ones of 1850 or 1780.”

Like Autor and Milanović, Piketty turns out to have concluded that the thesis of the Nice Unhappiness used to be, in key respects, improper.

It can be untimely to position worries about stagnating earning or emerging inequality to relaxation. The 3 former prophets of doom all emphasize the function that social and political elements play in shaping financial results. Consequently, they see contemporary salary enlargement for poorer American citizens as brought about partially by means of the expansionary financial insurance policies that each Donald Trump and Joe Biden pursued in line with the pandemic.

In a similar way, the large positive aspects that probably the most poorest folks on this planet have made in contemporary many years derive partially from their governments’ efforts to make use of business coverage to form the have an effect on of globalization on their international locations. Whether or not, as Piketty has argued, the returns on capital will ultimately outstrip the returns to hard work is determined by political selections about taxation and redistribution, in regards to the power of industry unions and the foundations governing hard work markets.

Contemporary excellent information about our financial potentialities must now not lead us to conclusions that might briefly turn into overexuberant. However we must additionally keep away from perpetuating an instinctive pessimism that appears much less and not more warranted. Even if pessimism would possibly appear good or shrewd, cynicism about our collective skill to construct a greater global handiest makes it more difficult to win beef up for the type of financial insurance policies we wish to create that long term.

Progressives on occasion appear to imagine that they are able to mobilize folks by means of making the long run glance frightening. But if electorate really feel threatened, it’s most often unscrupulous reactionaries who make unrealistic guarantees and scapegoat outsiders who receive advantages. Salary stagnation and emerging inequality are nonetheless actual risks about which we should stay vigilant—however the truth that a greater financial long term has come to seem a excellent deal extra achievable must be purpose for full-throated birthday celebration.

[ad_2]